- (021) 38230856

- info@koohigothhospital.org.pk

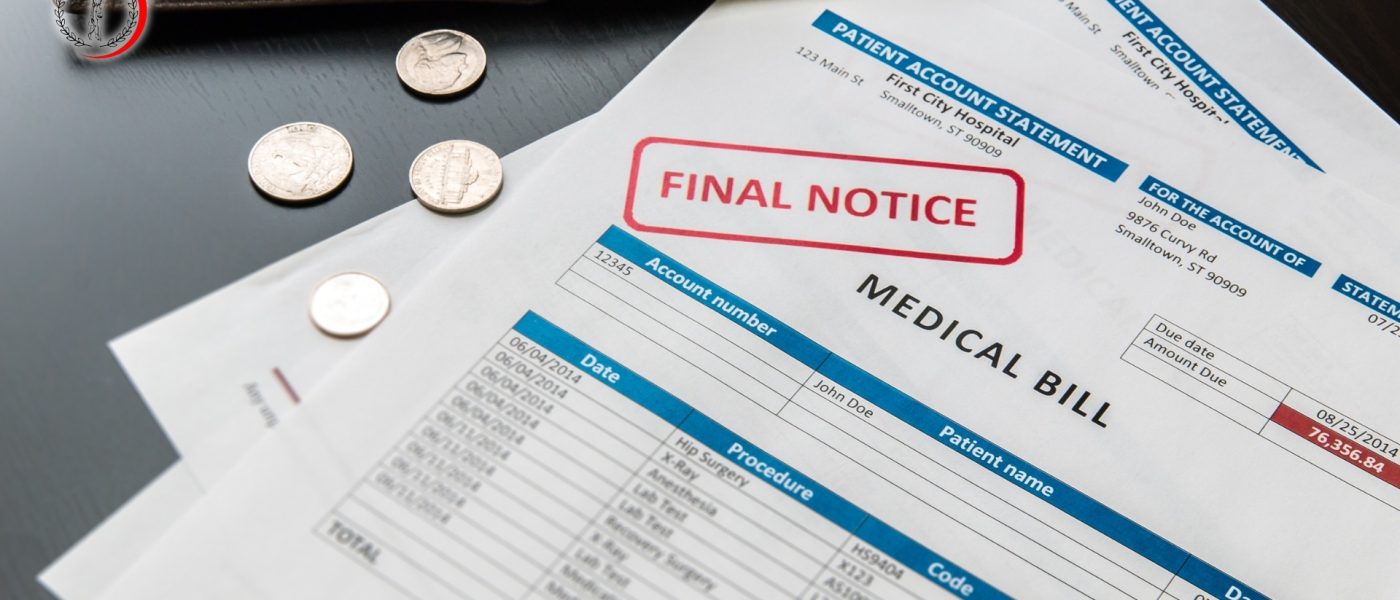

Post: Can a Hospital Take Your House for Unpaid Medical Bills?

Home

News

Single Post

Particularly following a major sickness or accident, medical costs can quickly mount up. Many curious people wonder, can a hospital take your house for unpaid medical bills? The brief response is: your financial status, where you live, and how legally the debt is managed will all affect this.

We will discuss in this article whether a hospital can take your house, what happens when you fail to pay medical expenses, and how you might guard your assets and residence. Therefore, we will use plain language so that everyone may grasp and act sensibly to protect their property.

Can a hospital take your house for unpaid medical bills?

Let’s start with the main question: Can a hospital take your house for unpaid medical bills?

Usually, hospitals cannot directly pick up from your house; instead, they can sue you for unpaid medical bills. Should they prove their case in court, they might put a lien on your property. Therefore, a lien is a legal claim entitling them to be paid back when your house is refinanced or sold.

Though they can still claim half of the proceeds should you ever sell or refinance your house, technically, they do not take it like a bank would in a foreclosure.

What is a lien on property?

A property lien is a legal notification alerting you to debt related to your dwelling. Should a hospital or doctor sue you and obtain a court ruling, they may place a lien on your house.

That implies as follows:

- You still call your place home.

- Therefore, refinance or sell it without paying off the debt.

- The lien remains on the property till the obligation is paid.

When people ask, can a hospital take your house for unpaid medical bills it’s really about whether a lien can be utilized to recover medical debt—and the answer is yes, in many jurisdictions.

Could You Be Made to Sell Your House?

Usually, no, particularly if your main residence is involved. Since homestead protection rules in several states ban creditors from pressuring the sale of your house to cover debt.

As such:

- Homestead protections are significant in Texas and Florida.

- Under specific criteria, other states could allow compelled sales.

- If you run across this problem, be sure to review your state legislation or consult a local attorney.

Again, although it is quite rare, the legal process and usually limited response to Can a hospital take your house for unpaid medical bills is yes.

Should you fail to pay your medical bills?

Therefore, ignoring your medical invasions could lead to:

1. Late Charges and Phone Calls for Collections

Also, after sixty to ninety days, your bill could be sent to a debt collector.

2. Credit Score Damage

After a 12-month grace period, unpaid medical debt can sour your credit.

3. Suits for Lawsuits

The bill collector or hospital could file lawsuits.

4. Lien and Judging

Should they prevail in the litigation, they can ask for a lien on your house or garnish your pay.

Therefore, asking Can a hospital take your house for unpaid medical bills is not only about losing your house but also about realizing how debt could follow you if it is not taken care of early on.

How Might Medical Debt Affect Your Home? Protection Strategies

These doable actions will help you avoid losing your house or dealing with a lien:

1. One seeks financial help

Many hospitals use sliding-scale billing depending on income or provide charity care.

2. Create a payment schedule

Bargain for a monthly payment you can afford before the bill goes to collection.

3. Investigate billing mistakes

Common medical billing errors: seek an itemized bill and closely analyze it.

4. See a Nonprofit Credit Counselor

They can assist in your debt communication and financial organization.

5. Homestead Exemptive File

Should this legal protection be accessible in your state, it will help to guard your house from creditors.

Early action can help prevent a lawsuit and remove the possibility of lien placement on your property.

Should a lien already exist, what would happen?

Should medical costs impose a lien on your residence, you still have choices:

- Work out a settlement to pay less than the whole due.

- Plan your payments to have the lien released.

- Refinance or sell the house and pay off the loan with earnings.

- See a lawyer to investigate legal remedies, particularly if the lien is unjustified.

- Moreover, acting is never too late, even if you already find yourself in legal hot water.

Homeowners and Senior Citizens: Extra Thought

This question: Can a hospital take your house for unpaid medical bills worries many seniors, particularly.

If you are on Medicare or over 65:

- Medicare does not cover everything, hence out-of-pocket costs can still be rather costly.

- You might be eligible for Medicaid programs that stop debt collectors from touching your house or state-level property protection.

- For information specific to your circumstances, ask local legal assistance agencies or elder centers.

Koohi Goth Hospital: compassionately supporting women’s health

Based in Karachi, Pakistan, Koohi Goth Hospital is a nonprofit medical center designed to treat women with obstetric fistula and other gynecological problems. Often without access to appropriate healthcare, the facility offers women from low-income and rural areas free surgeries, medical treatment, and rehabilitation. Apart from providing treatment, Koohi Goth Hospital is very important in teaching female healthcare professionals and midwives, thus enhancing the health outcomes throughout Pakistan.

Also, combining medical treatments with outreach and education helps the hospital enable women to lead better, more respectable lives. For thousands of women annually, their efforts not only improve physical health but also help to recover confidence and optimism.

Final Notes

Can a hospital take your house for unpaid medical bills? Not directly, but should you overlook the debt, they could file a lawsuit, get a court ruling, and attach your house.

Moreover, depending on state rules, that lien can restrict your ability to sell or refinance and, in rare situations, cause a forced sale.

Your best line of protection is:

- Stay aggressive.

- Engage in correspondence with the hospital.

- Demand assistance.

- Know your rights.

Though it is frightening, you have rights and choices about medical debt. Also, wait, not until it turns into a legal matter. Early action will help you to safeguard your house, credit, and peace of mind.